“The Constitution is not an instrument for the government to restrain the people, it is an instrument for the people to restrain the government - lest it come to dominate our lives and interests.”-Patrick Henry

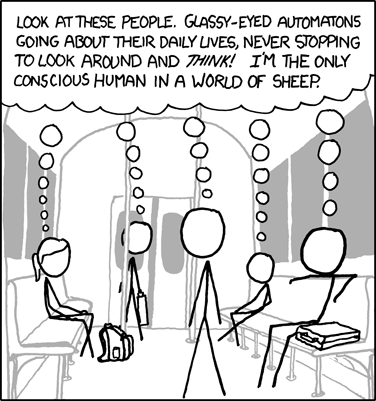

“The Constitution is not an instrument for the government to restrain the people, it is an instrument for the people to restrain the government - lest it come to dominate our lives and interests.”-Patrick Henry With the financial collapse of California there is a lot of finger pointing and shouting about whether California is spending too much (Republicans) or not collecting enough taxes (Democrats). The spenders claim that there will be hardships for the people if deep cuts are made. Personally I think the public has become too dependent on government handouts and support.

For example we think that government spending is essential for free education and yet for many decades the quality of US public schools has been very low. (In 2000, only 12 percent of graduating seniors were rated "proficient" in science, and international surveys rank our graduating seniors 19th overall out of 21 nations.) Those with money gladly pay for private education while still being taxed for public schools. Some economists have argued that we would be better off privatizing the school system with subsidies or vouchers to low income families. As it stands now we subsidize a huge bureaucracy of teachers and administrators and school boards with no penalties for poor performance and no incentives for good performance. See “A World without Public Schools” for more details.

Out of the blue, I decided to figure out how much the Federal Government costs the American people. Are we getting our money’s worth? The Federal Budget for 2009 (not counting TAARP and the Stimulus which are extra) is 3.1 trillion dollars. The official US population is 306 million. So we could say the cost of government is a little over $10,000 for every resident. That does not sound too bad.

But where does that money come from? Taxes on working adults. Let’s exempt 27.7% of the population who are under age 20 and 12.6% who are 65 and older. If we tax every person aged 20 to 64 (183 million persons) then each would contribute almost $17,000 annually.

Sadly not every adult is employed. Some are taking funds from the government via the many health and welfare programs instead of contributing. Also for this exercise, I’d like to exclude the 22 million persons who are directly employed by Federal and State governments (Military, Civil Servants) and those indirectly employed via government grants and programs. Any taxes they pay just return the government’s money to itself.

This leaves us with 109 million persons employed in the private sector and a tax burden of $28,440 each. (Interestingly if look at the number of total households, we get a similar figure of $27,433 per household. But let’s stick with actual private wage earners.)

Is $28,400 per earner reasonable or is it too much? Let’s look again at the median wage, $25,737. “Median” means that 50% of working Americans earn less than $25,737. So the cost of the Federal government (if evenly distributed) would consume the entire wage of over half the working population. This figure gets even worse if we include state and local taxes.

So how does the government stay afloat? Two ways: taxing the rich and taxing companies. Since the average worker does not have the funds the government needs, the federal budget must rely on taxes from high income earners, let’s say the top 25% to cover the other 75%. However top earners who are over taxed (e.g. 50% rate) may “go John Galt” and opt out of taxes by leaving the country, finding tax shelters, or cheating on their taxes thus reducing revenue collection.

What about taxing companies? In a phrase popularized by Robert Heinlein, “There Is No Just Thing As A Free Lunch.” Companies create products and services that are sold for a profit. Companies must generate the taxes paid by either reducing expenses (like wages) or charging more for their product. So corporate taxes eventually mean less income for workers or customers. I’m not saying corporate tax is bad but it helps to think of it as a hidden sales tax.

Bottom Line

After examining the numbers I’ve concluded that the Federal Government spends too much. No government should consume per capita more than the earnings of over half its privately employed population.

Resources

The Obsolete New York Model, Where a tax-eating majority votes itself a permanent income

The True Size of Government (1999 but still interesting)

US Households Census

Bureau of Labor and Statistics

Average & Median Wages

Update:

Tax Burden of Top 1% Now Exceeds That of Bottom 95%. “Newly released data from the IRS clearly debunks the conventional Beltway rhetoric that the ‘rich’ are not paying their fair share of taxes. Indeed, the IRS data shows that in 2007—the most recent data available—the top 1 percent of taxpayers paid 40.4 percent of the total income taxes collected by the federal government. This is the highest percentage in modern history. By contrast, the top 1 percent paid 24.8 percent of the income tax burden in 1987, the year following the 1986 tax reform act.”

Labels: Government, Taxes

“Time flies like an arrow; fruit flies like a banana”-Groucho Marx

“Time flies like an arrow; fruit flies like a banana”-Groucho Marx